1099 Nec Due Date 2024 Range – The IRS launched IRIS, a new free online portal, for businesses to file 1099 returns. (Beginning January 2024 MISC. “NEC” stands for “non-employee compensation”. It is due to . If you’re a freelancer, an independent contractor, or earn income from other sources outside of a traditional job, you should have received a 1099 for 2024 are due by the following dates .

1099 Nec Due Date 2024 Range

Source : www.tax1099.comHow to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.comHow to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.com1099 For Property Management: Everything To Know | Buildium

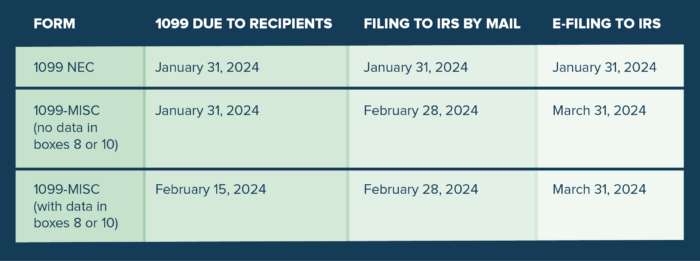

Source : www.buildium.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Jimenez Multi Services LLC | Mesa AZ

Source : m.facebook.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.comPenalties for Missing the 1099 NEC or 1099 MISC Filing Deadline

Source : www.tax1099.comHow to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.comRockin S Tax Preparation & Bookkeeping | Sheridan MT

Source : m.facebook.com1099 Nec Due Date 2024 Range IRS Form 1099 NEC Due Date 2024 | Tax1099 Blog: tool. The deadline to file your 2023 income taxes is April 15, 2024, unless you live in Maine or Massachusetts (in which case it’s April 17). Keep in mind this is the federal due date — your . The best tax software can help you file your federal and state tax returns easily and without having to shell out big bucks. In fact, many online tax prep tools featured on this list are free for .

]]>